Nj Quarterly Sales Tax Due Dates 2025

Nj Quarterly Sales Tax Due Dates 2025. Exemptions to the new jersey sales tax will vary by state. File nj sales tax returns monthly or quarterly.

What items are eligible for the sales tax holiday? Exemptions to the new jersey sales tax will vary by state.

For Quarterly Filers, Sales Tax Returns Are Due On The 20Th Of The Month Following The End Of The Reporting Quarter.

File by mail must be postmarked by the.

If The Due Date Falls On A Weekend Or Legal Holiday, The Return And Payment Are Due On The.

Quarterly sales and use tax returns are due before 11:59 p.m.

Nj Quarterly Sales Tax Due Dates 2025 Images References :

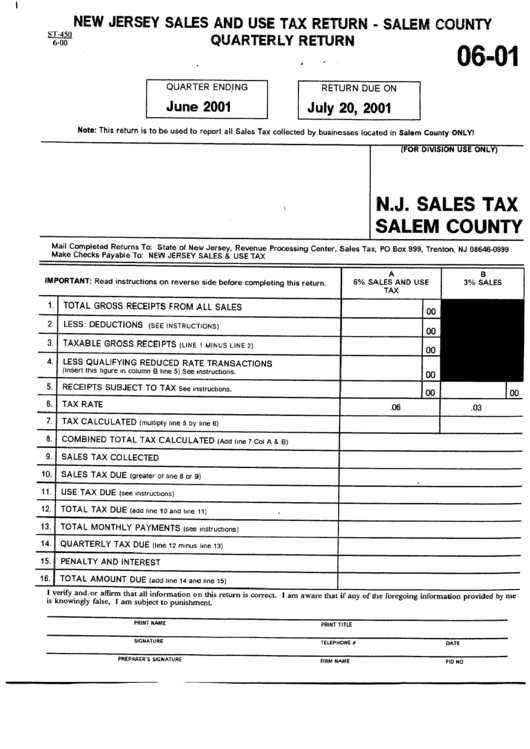

Source: www.formsbank.com

Source: www.formsbank.com

New Jersey Sales And Use Tax Return Salem County Quarterly Return, Sales and use tax login. New jersey sales tax tax due dates.

Source: jainebquintilla.pages.dev

Source: jainebquintilla.pages.dev

Nj Estimated Tax Payments 2024 Due Dates Tessi Quentin, Estimated payments are divided into four equal payments. Sales tax returns in new jersey are due on the 20th of the month following the reporting period.

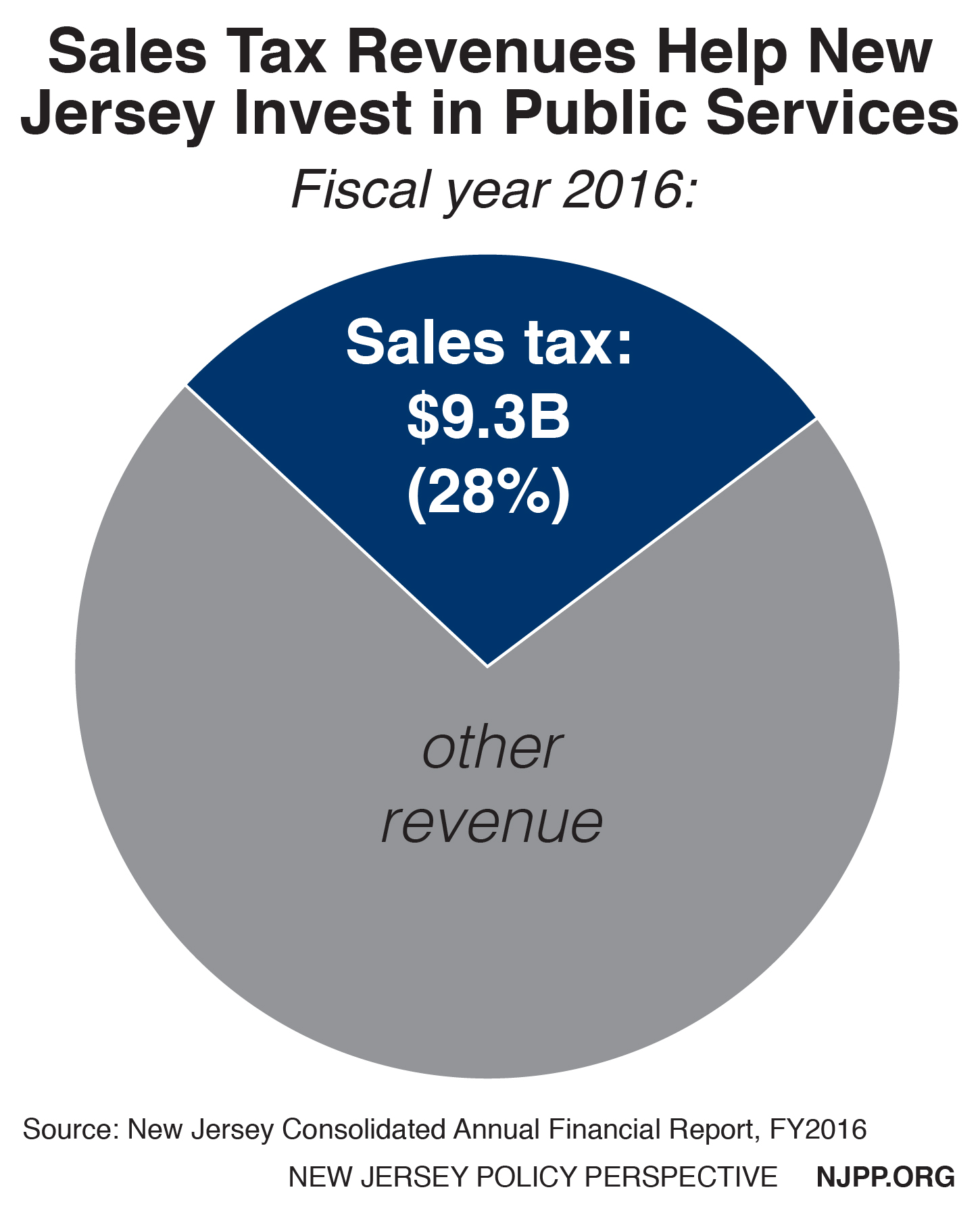

Source: www.njpp.org

Source: www.njpp.org

Modernizing New Jersey’s Sales Tax Will Level the Playing Field and, The next upcoming due date for each filing schedule is. File online with the division of taxation's online services.

Source: jadabgiulietta.pages.dev

Source: jadabgiulietta.pages.dev

2025 Quarterly Tax Dates Elka Martguerita, Sales and use tax login. However, a sales tax increase could be considered.

Source: jackylilian.pages.dev

Source: jackylilian.pages.dev

2024 Quarterly Estimated Tax Due Dates Irs Ailey Anastasie, In new jersey, although most sales tax filers file and. When to make estimated payments.

Source: alysashandra.pages.dev

Source: alysashandra.pages.dev

Extended Tax Deadline 2025 Linda Paulita, Please choose one of the following options to log in to new jersey's sales and use tax filing and payment service. New jersey sales tax tax due dates.

Quarterly Sales Tax Report Google Sheets, Fourth quarter 2024 estimated tax payment due; When you register for your new jersey sales tax permit, the state assigns you a filing frequency and sales tax due dates.

Source: blog.accountingprose.com

Source: blog.accountingprose.com

New Jersey Sales Tax Guide, They are made quarterly, with specific payment due dates. Please choose one of the following options to log in to new jersey's sales and use tax filing and payment service.

Source: www.njpp.org

Source: www.njpp.org

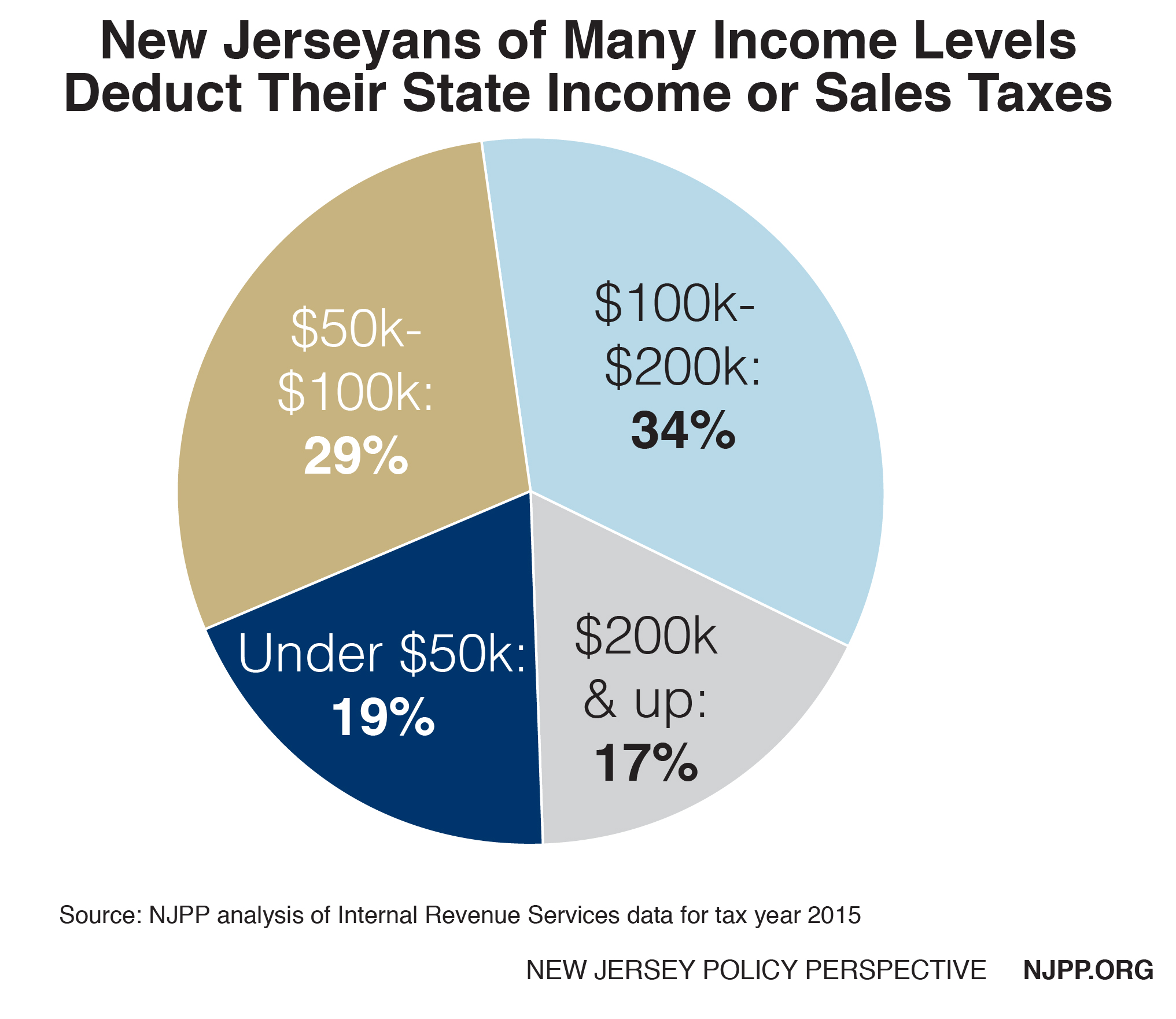

Fast Facts Millions of New Jerseyans Deduct Billions in State & Local, Then, charge 6.625% sales tax on all taxable nj sales. Of the 20th day of the month after the end of the filing period.

Source: sprite-midgetclub.org

Source: sprite-midgetclub.org

nj sales tax chart, Please choose one of the following options to log in to new jersey's sales and use tax filing and payment service. When to make estimated payments.

Our Free Online Guide For Business Owners Covers New Jersey Sales Tax Registration, Collecting, Filing, Due Dates, Nexus Obligations, And More.

The new jersey sales tax rate is 7% as of 2024, and no local sales tax is collected in addition to the nj state tax.

In New Jersey, Although Most Sales Tax Filers File And.

Please choose one of the following options to log in to new jersey’s sales and use tax filing and.