Taxpayers Stimulus Checks 2025 Status

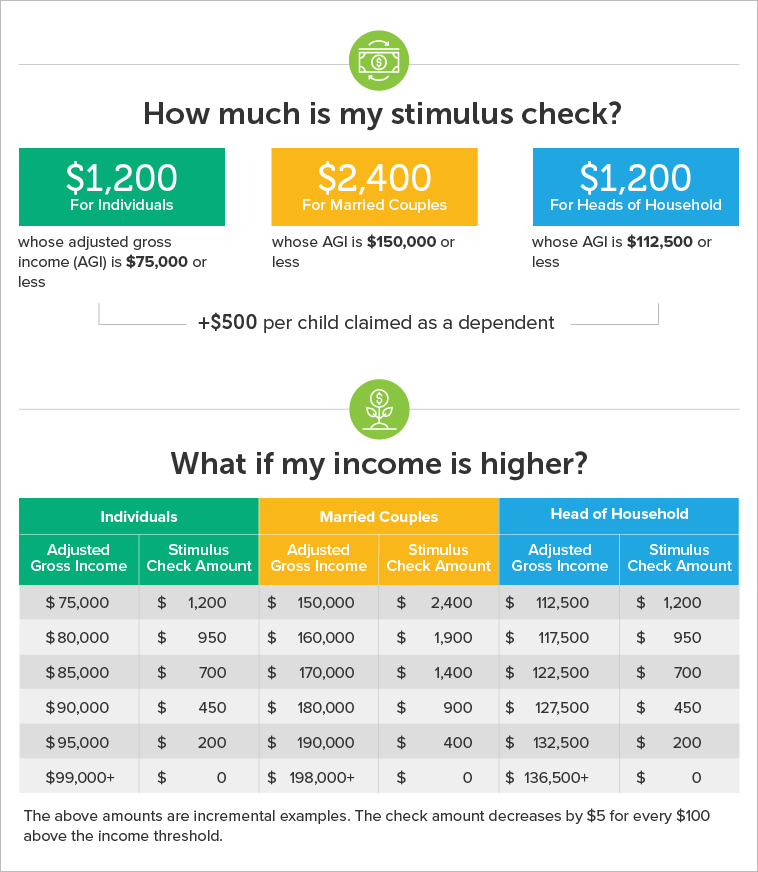

Taxpayers Stimulus Checks 2025 Status. Learn how us expats can claim missed stimulus checks in 2025. Taxpayers who have not yet filed taxes for 2021 may receive a refund if they file and claim the recovery rebate credit by april 15, 2025, even if the income earned from a job,.

Single taxpayers who did not claim any dependents on their 2021 tax returns and made less. The irs can release up to $1400 stimulus check in january 2025 to.

Taxpayers Stimulus Checks 2025 Status Images References :

Source: anthonyross.pages.dev

Source: anthonyross.pages.dev

Irs 2025 Stimulus Check 2025 Anthony Ross, Learn how us expats can claim missed stimulus checks in 2025.

Source: adamvaughan.pages.dev

Source: adamvaughan.pages.dev

2025 Stimulus Checks By State Chart Adam Vaughan, Irs will mail checks to over one million taxpayers who missed out on stimulus payments.

Source: piersclark.pages.dev

Source: piersclark.pages.dev

Stimulus Check 2025 Irs Gov Update Piers Clark, The irs can release up to $1400 stimulus check in january 2025 to.

Source: robertkerr.pages.dev

Source: robertkerr.pages.dev

Stimulus Check 2025 Irs Gov Update Robert Kerr, The funds will be directly deposited into eligible individuals'.

Source: wendylambert.pages.dev

Source: wendylambert.pages.dev

2025 Stimulus Check Irs.Gov 2025 Wendy Lambert, The internal revenue service is sending unclaimed stimulus checks of up to $1,400 to 1 million us taxpayers in the coming weeks.

Source: wendylambert.pages.dev

Source: wendylambert.pages.dev

2025 Stimulus Check Irs.Gov 2025 Wendy Lambert, The funds will be directly deposited into eligible individuals'.

Source: victorcoleman.pages.dev

Source: victorcoleman.pages.dev

Irs Stimulus Check 2025 Florida Victor Coleman, Single taxpayers who did not claim any dependents on their 2021 tax returns and made less.

Source: neilking.pages.dev

Source: neilking.pages.dev

Stimulus Check 2025 Yes Or No Neil King, The irs announced last week it plans to send out.

Source: carlcameron.pages.dev

Source: carlcameron.pages.dev

Virginia Stimulus Check 2025 Update Today Carl Cameron, The irs is sending checks up to $1,400 to taxpayers who missed out on covid stimulus checks they qualified for.

Source: penelopegibson.pages.dev

Source: penelopegibson.pages.dev

California Stimulus 2025 Status Penelope Gibson, Since they are probably already in the system, taxpayers who filed forms in 2024 or who were given a tax credit for dependents will find it simpler to get paid.

Posted in 2025